Prepare for 2025 with insight from our specialists in technology, skills, regulation, and financing. We combine the latest data from our Business Outlook Tracker with analysis of the pressing issues facing you right now, from tackling sophisticated cybercrime to overcoming barriers to accessing finance.

Data for this insight is sourced from the December findings of our Business Outlook Tracker, a survey every two months of 800 senior decision makers in businesses with revenue from £50 million to £1 billion – plus.

Economic outlook

As most were logging off for the festive season, the Bank of England (BoE) downgraded its 2025 growth forecasts and warned that interest rates will fall more slowly than anticipated.

While the Government’s strategy of trailing a ‘bad news Budget’ prevented market volatility, it hit mid-market business confidence. Revenue-growth optimism dropped by minus 8pp between February and December, and optimism in their funding position fell by minus 9pp. The BoE now predicts no growth for the first three months of 2025.

Sixty eight percent of respondents said that a lack of available funding is negatively impacting their ability to boost productivity. The mid-market wants to invest in areas such as research and development (R&D), and technology to fuel growth, but higher operating costs are impacting their ability to service debt and attract additional funding.

Two solutions are emerging from the Government. The Competition and Markets Authority (CMA) is looking to reduce red tape around mergers and acquisitions. This paves the way for large corporates (who have the funds to facilitate R&D) to seek deals in the mid-market. The Government is also seeking to ‘crowd in’ private sector investment by essentially investing in private companies through vehicles like the National Wealth Fund (formally UKIB) and local authority grants.

Cost management

A stark difference in optimism between the mid-market and large corporates suggests that Budget measures, such as increases to employer National Insurance Contributions (NICs) and the National Minimum Wage (NMW), have hit smaller companies harder.

After years of managing high inflation and wage growth, the mid-market will be wondering where to find efficiencies. Unlike larger companies, they don’t have the funding to mitigate labour costs with technology.

Companies of all sizes will be waiting to see how President Trump’s rhetoric on tariffs plays out and the extent to which it will impact the UK. A mooted 20% import tax would be a significant barrier to international expansion. Meanwhile, ongoing and emerging political change or conflict in Syria, the Middle East, and Ukraine will continue to destabilise supply chains.

You can read the full insight here: Navigating 2025 | Grant Thornton

Author: Grant Thornton

Date: 1 November 2024

In today's rapidly changing business environment, our latest CFO Pulse Survey finds CFOs are facing unprecedented challenges and opportunities.

Author: Grant Thornton

Date: 11 July 2024

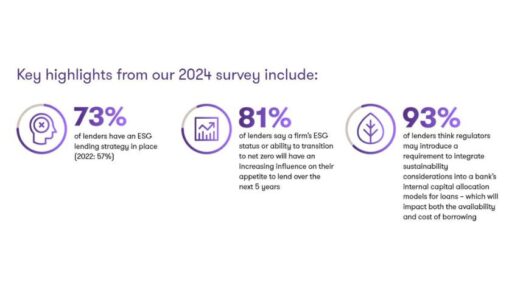

We surveyed nearly 50 UK-based lenders to understand their attitude and strategy towards ESG and sustainable finance for the mid-market, and what this

Author: Grant Thornton

Date: 31 May 2024

Leading business and financial adviser Grant Thornton UK LLP and Teesside University today announced the launch of a new apprenticeship to build susta