Sustainable finance is not currently the hot topic that it was a couple of years ago. Challenging economic conditions have led firms to prioritise other issues, and there have been concerns around greenwashing.

But mid-market firms should not be lulled into a false sense of security. The forces driven by ESG that influence lenders to become increasingly selective over which borrowers they support, and at what price, are not going away and will only ramp up over time. Jon Bramwell shares results from our survey of mid-market lenders to understand the direction of travel.

See the full article here: ESG and access to capital: the mid-market needs to stay alert | Grant Thornton

Author: Grant Thornton

Date: 26 June 2025

With employment costs climbing, now’s the time to rethink your reward strategy.

Author: Grant Thornton

Date: 17 June 2025

If your company invests in innovation, the latest changes to the UK’s R&D tax relief system could significantly impact your claims.

Author: Grant Thornton

Date: 9 June 2025

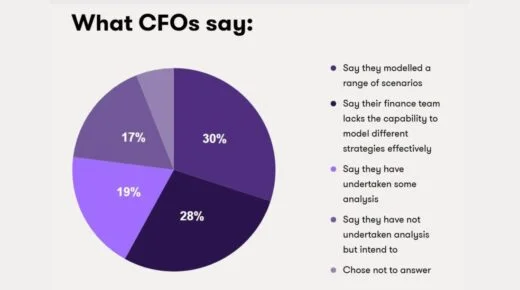

Our experts unpack how UK-based CFOs plan to respond to the tariffs landscape across several areas, from scenario analysis to customs.