The Labour Chancellor, Rachel Reeves’ 2024 Autumn Budget brought some critical changes that will impact UK business owners, entrepreneurs, and SMEs. Here, we break down these updates into the essentials you need to know. These changes, affecting Employment Taxes, Corporate Taxes, Capital Gains Tax and other areas, may come with challenges but also some opportunities.

Our Tax experts, Jessica Cowling & Richard Lupson-Darnell have gone over all the announced changes to pick out the details and help you find a way to navigate these. Let’s get into it.

The Autumn Budget 2024 saw a substantial changes for employment taxes, including the increase in national living and minimum wage, employer NIC changes and payrolling of benefits to become mandatory.

Starting in April 2025, the National Living Wage (NLW) will increase by 6.7%, moving from £11.44 to £12.21 per hour. For younger workers (18–20-year-olds), the National Minimum Wage (NMW) will rise from £8.60 to £10 an hour.

On the Employer National Insurance Contribution (NIC) side, there’s a rise in the main rate from 13.8% to 15%, while the secondary threshold (the point where NIC kicks in) is reducing from £9,100 to £5,000 annually. To soften the impact, the Employment Allowance will increase from £5,000 to £10,500, which is no longer restricted to businesses with NIC liabilities of £100,000 or less. The allowance does not apply to personal service companies.

For businesses, this means that a typical employee paid £9,100 annually (just within the NIC limit prior to April 25) will now generate an employer NIC cost of £615 per year. Similarly, for an employee earning the average UK wage of £34,000, the NIC liability will rise by £914—from £3,436 to £4,350.

Payrolling benefits in kind will also become mandatory from April 2026, with exceptions like employer-related loans and living accommodations, which employers can voluntarily opt into including. While there’s a new system on the horizon for reporting, Class 1A benefit reporting (usually filed and paid in July each year) remains unchanged.

Our Advice:

A silver lining for R&D-focused businesses: these NIC increases can positively impact R&D claims, as personnel costs, including employer NIC, qualify as R&D expenditure. If your business falls under the tax credit cap (£20,000 plus 300% for the companies relevant PAYE and NIC liabilities), this may boost your R&D cash benefits slightly.

Additionally, for companies which have accrued bonuses which are usually paid per annum post April, we recommend that if cash flow is available that these are paid pre-April to attract more favourable employers NIC rates and liabilities.

Alongside the Budget, the Government has encouraged growth within the economy and long- term investment in projects through publishing the Corporate Tax Roadmap, setting out the plans for the entire duration of this parliament (5 years) and providing commitment.

Here’s a quick overview of the major points:

Our Advice:

We believe that this is positive outlook for our clients specifically those who fall within the innovation sectors, the road map can provide some comfort to our clients to keep on investing and developing within their industry.

Following the Autumn Budget 2024 announcement, the main rates of CGT have increased from 10% to 20% and 18% to 24% respectively, for disposals made on or after 30th October 2024. There is however special provision for contracts entered into on or before 30th October 2024 but completed after that date.

Business Asset Disposal Relief (BADR), used by business owners, sole traders, partners, shareholders, and trusts, allows disposal of business assets up to a lifetime limit of £1 million at a CGT rate of 10%. This rate will, however, rise to 14% from April 2025 and to 18% from April 2026, aligning with the new lower main rate.

Our Advice:

With this change in mind, we encourage our clients to be forward thinking with any tax planning they may be considering and utilise this relief sooner rather than later to attract more favourable CGT rates, particularly before April 2025 increases.

For Inheritance Tax purposes, transfers after 6 April 2026 qualifying for Business Property Relief (BPR) and Agricultural Property Relief (APR) which are available at 100% will be capped at £1million, this can include shares within a trading company. Where both BPR and APR is available then the allowance will be split proportionately and if exceeded the balance of relief will be at 50%. This allowance is not transferrable to a spouse and therefore if not utilised it will be lost.

Additionally, from April 2027, unused pension funds and death benefits will form part of an individual’s estate, with scheme administrators becoming responsible for reporting and paying any IHT due. The current “7-year rule” exemption remains unchanged, providing a valuable planning opportunity for gifting assets.

Our Advice:

Client should consider effective tax planning before these changes come into affect and we welcome conversations around these areas, in particular where individuals are looking to pass on their wealth and businesses to descendants.

From 30th October 2024, SDLT on residential properties worth £500,000 or more bought through companies will increase from 15% to 17%. The higher SDLT rates, generally applicable to second or buy-to-let properties for individuals or for companies/trusts purchasing properties, will also go up from 3% to 5%.

Our Advice:

When buying residential property, it is important to consider the vehicle you are purchasing through, as there are clear disincentives for using a corporate vehicle however in the right circumstance it may still be appropriate.

Samantha Gallagher (MPA)

Employment Law and HR perspective

In light of Chancellor Rachel Reeves’ Autumn Budget 2024, SME businesses should prepare for financial adjustments, including the National Living Wage increase to £12.21 per hour and an employer National Insurance contribution rise to 15% in April 2025. Although there is some support for smaller businesses, to manage these changes effectively, SMEs must adjust Budget planning, communicate transparently with staff about compensation updates, and explore enhancement opportunities to operational efficiencies to balance increased payroll costs.

Strategic workforce planning is key – optimise staffing by upskilling current employees, fostering employee retention through professional development, and creating clear career pathways. Additionally, consider streamlining recruitment processes, leveraging digital platforms and cost-effective methods such as referral programs, and hiring apprentices or trainees to build a strong, future-ready team. Developing an inclusive and supportive work environment will further enhance employee morale and resilience, allowing SMEs to adapt sustainably while maintaining a motivated workforce.

Associate Finance Director to SMEs

It seems that the Chancellor is asking UK businesses to do the heavy lifting to repair public finances. The increase to Employer’s NI, not only the 1.2% increase but the reduction in the starting threshold, places a heavy burden upon businesses of all sizes. Coming alongside an inflation-busting 6.7% rise in the National Minimum Wage, and significant changes to employment law, higher National Insurance contributions will be a bitter pill to swallow for UK businesses with SMEs possibly being most impacted, with the increase in the Employers Allowance giving little relief to many.

Rigorous forecasting and stress testing of these forecasts will be vital for businesses looking to absorb these cost increases or pass some or all of them on by way of price increases, and the pain will most keenly be felt in small businesses with limited cash resources and limited access to sources of funding.

For entrepreneurs and owners of growth businesses as well as those investors in these businesses there is more bad news. This budget contains increases to CGT and gradual increases to BADR (entrepreneur’s relief) which means taxes on investors and founders going up, but perhaps on this occasion founders’ worst fears have not quite materialised and some form of balance has been struck, including maintaining all R&D investment reliefs.

Managing Director and Group Board Executive

This is the first budget in a while with a lot for businesses and busy directors and where changes in one area, impact other areas of tax –e.g. increases in national insurance can improve R&D claims as noted above and may also push an SME into a lower tax rate through lower profits. It is therefore more important than ever to get an external financial perspective and a full understanding of the tax impact on your business of these changes and consequential business reactive changes, so as not to make a costly mistake. Speaking to an experienced FD to guide you will be an investment well made.

If you are a SME or business owner unsure of how to navigate the changes in the Autumn Budget, our experts are here to guide you through it. We can support you with strategic tax planning, tax efficient funding options, exit and succession planning, and many outsourced services such as HR and Finance teams. Please contact us for support – we’re here to move you forward.

Author: Michael Price Associates Limited

Date: 10 February 2025

With the NIC increase coming into effect in April 2025, join our experts as they talk through ways to manage the costs.

Author: Michael Price Associates Limited

Date: 14 January 2025

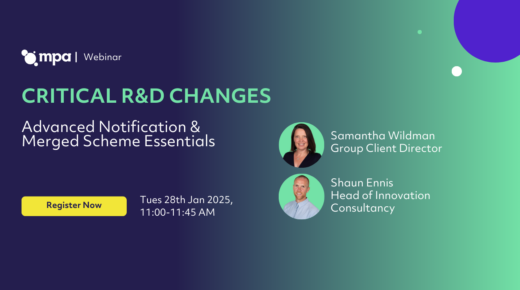

Failing to understand the new requirements—like the Advanced Notification Form—could put your funding at risk of being rejected. Join us to learn more

Author: Michael Price Associates Limited

Date: 4 November 2024

This webinar, is designed for business owners in the final stages of their exit journey, in light of upcoming changes in April 2025.