The Chancellor’s ‘Budget for long-term growth’ recognises that the inflation battle is not yet over – as the OBR says that the economy is doing better than expected. Still, we are entering a period of stagnating output.

In his Spring Budget speech, Jeremy Hunt said he had set out a plan to deliver long-term growth for the UK that will build a high-wage, high-skill economy with a path to more investment, more jobs, more productive public services, and lower taxes.

Recognising the vital role of small and medium enterprises (SMEs) in the economy, the Spring Budget built on the SME support measures from the Autumn Statement. In addition to raising the VAT threshold, key announcements include:

The Spring Budget contained several measures focused on encouraging business investment and growth:

The Spring Budget reaffirmed the Government’s commitment to making the UK a global leader in science and innovation. Building on the £750m R&D package announced in the 2023 Autumn Statement, the Chancellor unveiled several new measures:

Hunt also used the Budget to build on a wider Government strategy to support key sectors – including creative industries, advanced manufacturing, green industries, digital technology and AI, and life sciences – to drive economic growth and innovation.

Green Industries

Digital and AI:

Life sciences:

In a boost for small businesses, the VAT registration threshold will increase from £85,000 to £90,000 from 1 April 2024. This marks the first increase in seven years. The Chancellor said this would “reduce the administrative and financial impact” for SMEs, explaining it will bring approximately 28,000 small businesses out of collecting, reporting, and paying VAT altogether.

The main fuel duty rates will now remain frozen until March 2025 and the temporary 5p cut to the duty has also been extended. The Government estimates these measures will save car drivers around £50 in 2024/25 and £250 since the 5p cut was introduced, resulting in a total £5bn tax cut across the nation. Businesses that rely heavily on transportation, such as hauliers and delivery firms, will welcome this relief amid high fuel costs.

Employee National Insurance will decrease by 2 pence, from 10% to 8%, in April. This, along with the Autumn Statement’s 2 pence cut, means employee NICs will have decreased by one-third in less than six months. The average worker earning £35,400 will receive a tax cut of over £900 compared to last year. In addition, the self-employed will see a lower tax burden in April with a 2% point cut in Class 4 NICs, from 8% to 6%, and the scrapping of the requirement to pay Class 2 NICs, saving an average of over £650 annually for those earning £28,000.

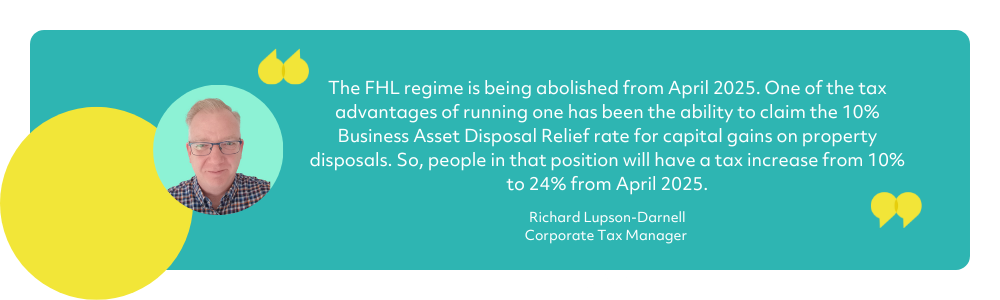

In a move to make the property market fairer for renters, the Furnished Holiday Lettings (FHL) regime will be abolished from April 2025. The change aims to increase long-term rental options for locals and raise tax receipts to help fund national insurance cuts. It is estimated that the change will raise around £300m from landlords who benefited from the furnished holiday lettings (FHL) scheme.Properties meeting the qualifying tests for FHLs are taxed under special rules and owners of such properties can access specific tax advantages not available for other lettings, including:

The Spring Budget of 2024 outlines a strategic plan for long-term growth, emphasising investment in SMEs, innovation, and key sectors. The government’s commitment to boosting research and development, coupled with targeted funding initiatives, aims to solidify the UK’s position as a global leader in science and innovation. Furthermore, the Budget introduces measures to ease the financial burden on small businesses, including an increase in the VAT registration threshold and extended relief on fuel duties. The reduction in National Insurance rates offers significant tax cuts for both employees and the self-employed, aiming to stimulate economic activity and support households during challenging times. As we move forward, the focus on investing in future industries, coupled with tax cuts and financial relief, sets a promising trajectory for business growth and economic resilience in the years to come. This proactive approach underscores the government’s commitment to fostering innovation, supporting small businesses, and driving sustainable economic development.

If you have any concerns about any of the changes and want to speak to someone, we’re here to help. Please get in contact with us here: https://www.mpa.co.uk/contact-us/

Author: Michael Price Associates Limited

Date: 10 February 2025

With the NIC increase coming into effect in April 2025, join our experts as they talk through ways to manage the costs.

Author: Michael Price Associates Limited

Date: 14 January 2025

Failing to understand the new requirements—like the Advanced Notification Form—could put your funding at risk of being rejected. Join us to learn more

Author: Michael Price Associates Limited

Date: 4 November 2024

This webinar, is designed for business owners in the final stages of their exit journey, in light of upcoming changes in April 2025.