In an ideal world, business owners would have an exit strategy in mind from day one – to align growth strategy with a future exit for the business and individual’s benefit. Most business owners haven’t had the time or space to consider their exit strategy from the beginning, and often unpredictable events can influence the need to exit.

Join our experts in this webinar to consider whether you have the right plans in place to maximise the benefits of your exit strategy They’ll cover:

• Why it is important to start exit planning early?

• When is the best time to sell your business and how to identify potential buyers?

• How can you structure the deal for maximum value?

• What are the common pitfalls in exit planning?

• Lessons you can learn from real-life case studies

Our expert speakers include:

MPA Corporate Tax Manager, Richard Lupson-Darnell

Richard is a seasoned expert in strategic business planning with extensive experience guiding business owners through every stage of their company’s lifecycle.

With a focus on strategic planning, Richard has a comprehensive understanding of transactional processes and the intricate details involved in preparing a business for eventual exit. He excels in advising clients on optimising share structures and navigating the complexities of the exit process, ensuring all necessary adjustments are made well in advance.

Richard’s proficiency extends to managing the tax aspects of due diligence and the extensive documentation required during the sale of a business. He is dedicated to ensuring that clients are well-prepared, with all elements meticulously organized to facilitate a seamless and efficient exit process. His hands-on approach and thorough preparation enable business owners to achieve successful exits with confidence.

With a commitment to strategic foresight and meticulous planning, Richard provides invaluable support to business owners, helping them align their operations with long-term goals and maximize the value of their businesses.

EFM Portfolio Finance Director, Ravi Maheswaran

Ravi, a Portfolio Finance Director at the EFM network, specialises in business exits, focusing on financial strategy to maximise value and ensure a smooth transition. His expertise encompasses managing various exit scenarios, from trade sales to Management Buyouts offering guidance and emphasising the significance of timing and robust management information in order to enhance value. Ravi also specialises in financial due diligence for buyers entering a potential transaction.

Ravi’s strategic insights and hands-on approach make him a trusted advisor for business owners contemplating an exit. His understanding of the SME sector and his skill in aligning strategies with each business’s unique requirements, ensures owners have the best chance of achieving their goals.

An outstanding accomplishment includes successfully selling a company for £8 million despite very limited management information and internal shareholder disagreement, demonstrating his ability to optimise value under challenging circumstances.

When: Thursday 6th June, 11:00-11:45

Where: Online

Author: Michael Price Associates Limited

Date: 10 February 2025

With the NIC increase coming into effect in April 2025, join our experts as they talk through ways to manage the costs.

Author: Michael Price Associates Limited

Date: 14 January 2025

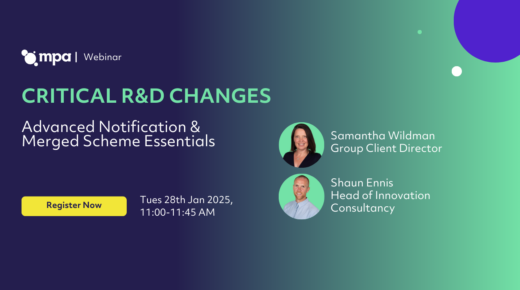

Failing to understand the new requirements—like the Advanced Notification Form—could put your funding at risk of being rejected. Join us to learn more

Author: Michael Price Associates Limited

Date: 4 November 2024

This webinar, is designed for business owners in the final stages of their exit journey, in light of upcoming changes in April 2025.